11 septiembre, 2024

Most of the companies in the top indexes meet this standard, as seen from the examples of Microsoft and Walmart mentioned above. However, it may also indicate overvalued or overbought stocks trading at high prices. It is unusual for a company to trade at a market value that is lower than its book valuation. When that happens, it usually indicates that the market has momentarily lost confidence in the company. It may be due to business problems, loss of critical lawsuits, or other random events. In other words, the market doesn’t believe that the company is worth the value on its books.

Calculating Depreciation

The formula states that the numerator part is what the firm receives by the issuance of common equity. That figure increases or decreases depending upon whether the company is making a profit or loss, and then finally, it decreases by issuing dividends and preference stock. Price-to-book (P/B) ratio as a valuation multiple is useful when comparing similar companies within the same industry that follow a uniform accounting method for asset valuation. It can offer a view of how the market values a particular company’s stock and whether that value is comparable to the BVPS.

Share this article

Vivek asks him to compute P/BVPS for SBI and then compare peer-to-peer. Note that if the company has a minority interest component, the correct value is lower. Minority interest is the ownership of less than 50 percent of a subsidiary’s equity by an investor or a company other than the parent company. While the pricing information can be quite useful, the main disadvantage of searching NADA RV values is the user experience. From landing on the NADA RV value website, you’ll navigate options on seven different screens before you have an idea of what the RV in question is worth.

What Book Value Means to Investors

- And, your business’s book value is the same as the equity listed on your balance sheet.

- But you might also want to check how much an RV is worth when shopping for used RVs, as they can help you compare pricing to find the best deal possible.

- Book value meaning implies the amount a company’s shareholders will receive if the business shuts down without selling its assets at a loss and settles its debt.

When we talk about book value relative to a fixed asset, it refers to the original cost of an asset minus any accumulated depreciation. Assets are recorded on the balance sheet, an essential financial document showing your company’s assets and liabilities. As an example, consider this hypothetical balance sheet for a company that tracks the book value of its property, plant, and equipment (it’s common to group assets together like this). At the bottom, the total value accounts for depreciation to reveal the company’s total book value of all of these assets.

What is the approximate value of your cash savings and other investments?

This means investors are willing to risk more than BVPS for the stock’s potential upside. Measuring the Value of a ClaimA good measure of the value of a stockholder’s residual claim at any given point in time is the book value of equity per share (BVPS). Book value is the accounting value of the company’s assets less all claims senior to common equity (such as the company’s liabilities). You need to know how aggressively a company has been depreciating its assets. This involves going back through several years of financial statements. If quality assets have been depreciated faster than the drop in their true market value, you’ve found a hidden value that may help hold up the stock price in the future.

What is the difference between a book value and a fair market value?

This will help your company decide if they should make changes to improve financial performance. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

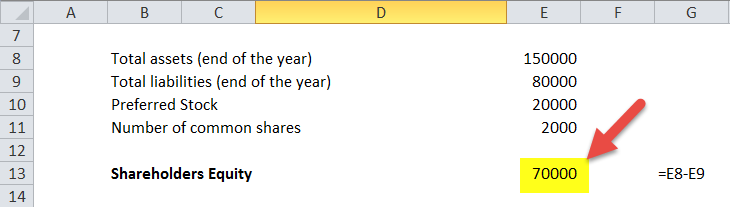

Additionally, it is also available as shareholders’ equity on the balance sheet. Suppose that XYZ Company has total assets of $100 million and total liabilities of $80 million. If the company sold its assets and paid its liabilities, the net worth of the business would be $20 million. The book value literally means the value of a business according to its books or accounts, as reflected on its financial statements. Theoretically, it is what investors would get if they sold all the company’s assets and paid all its debts and obligations.

Ultimately, accountants must come up with a way of consistently valuing intangibles to keep book value up to date. When creating a benchmark analysis, you first xero shoes barefoot minimalist zero need to make normalizing adjustments. “Normalizing” in the accounting world refers to a company’s regular earnings — minus non-recurring charges and gains.

However, it is often easier to get the information by going to a ticker, such as AAPL, and scrolling down to the fundamental data section. NADA RV values include a suggested list price, a low retail price, and an average retail price. One advantage this site offers is the ability to research base RV pricing or input features and options across various categories for a more accurate valuation. Several RV valuation tools help you find an estimated RV value by VIN or by using the RV’s year, make, and model. Many know Kelley Blue Book as a trusted resource for automobile valuation, but you won’t find KBB RV values on that site.