22 mayo, 2024

This is an example of how direct and indirect costs appear on a company’s income statement. Underpinning the versatility of cost accounting are the varied categories of cost objects, each distinct in how they capture and reflect the nuances of expenditure. This segmentation enables businesses to intricately trace where their resources are utilized and support strategic financial decisions across diverse operational facets. Advances in technology have made it easier for businesses to manage their costs and allocate them to cost objects. Cost accounting software can give businesses real-time data and analytics to make informed business decisions.

Importance: Top 5 Benefits of Cost Management

Since 2014, she has helped over one million students succeed in their accounting classes. Mobile analytics has become an indispensable tool for businesses seeking to understand and optimize… Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Imagine trying to track every expense in a busy corporation without knowing which parts of the business they should be tied to – that’s like navigating through dense fog without a compass. For example, in the construction of a building, a company may have purchased a window for $500 and another window for $600.

Importance of Defining Cost Objects

- Mobile analytics has become an indispensable tool for businesses seeking to understand and optimize…

- Sometimes management has to decide if it is economically feasible to determine if a cost is direct or indirect.

- To make the matter even more complicated, direct and indirect expense categories can vary among different industries and even within the same business.

- Cost accounting software can give businesses real-time data and analytics to make informed business decisions.

- Some businesses may have complex operations, making assigning costs to cost objects challenging.

- For example, licensing fees, trade association dues, and customer freebies are all examples of business-related costs.

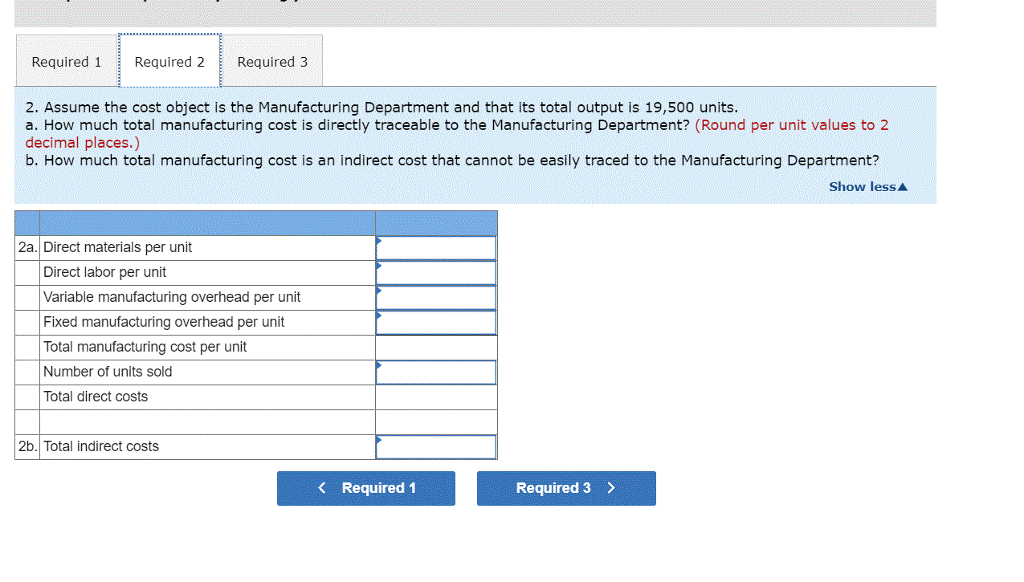

We will also discuss the benefits and challenges of using cost objects for decision making. Contrastingly, common costs, also known as indirect costs or allocated costs, can’t be traced directly to a single cost object. Examples include the salaries of corporate executives or the utilities for a factory that produces multiple products.

Cost Reduction – How Are Cost Objects Used in Cost Accounting

In practice, there are several costing methods used to allocate indirect costs, such as activity-based costing (ABC) or fixed cost classification. Each method has its own pros and cons, for example in terms of impact on pricing, the profitability ratio and company evaluation financial reporting and taxation. The most common examples of indirect costs include the following expenditures, assuming they are not specific to a cost object, such as a product, service, department or project.

By assigning costs to specific objects such as products, services, or departments, managers can identify areas of inefficiency or high costs and take appropriate actions to optimize operations. This enables them to make data-driven decisions and improve overall organizational performance. This company defines each project as a cost object, and traces the direct costs of labor, materials, and software licenses to each project. It also allocates some indirect costs, such as overhead, depreciation, and marketing, based on a percentage of the direct costs. The company uses cost object information to monitor the profitability and efficiency of each project, and to set competitive prices for its services.

Cost Tracing Techniques for Accurate Cost Allocation

It is the cost that is paid in total to cover all cost objectives in different business units, locations,s and so on. Proper cost classification will also come in handy when it is time to file a business tax return as some direct and indirect expenses may be tax deductible. Although most direct costs tend to be variable, there are exceptions to the rule and some direct costs may be considered fixed. Allocating costs to these relationships is critical for understanding their true value and overall impact on profitability. For instance, knowing the cost of acquiring a new customer helps in setting prices that keep the business competitive while still profitable. Cost objects help with this by giving each expense its own category and price tag.

However, achieving accuracy can be difficult, mainly if the data is incomplete or inaccurate. Businesses may need to implement procedures to ensure data accuracy in cost allocation. Management accountants are responsible for analyzing and reporting on the organization’s financial performance. They often play a key role in assigning costs to cost objects, as they deeply understand the organization’s financial systems and processes. In accounting and finance, a cost object consumes resources or generates costs within a business or organization.

Cost objects can also be used to track the cost of specific production processes, such as assembly, machining, or testing. By understanding the cost of each process, manufacturers can identify inefficiencies, reduce waste, and optimize production to improve profitability. By using a project as a cost object, businesses can identify areas where they may be able to reduce costs and improve their efficiency.

This can help them minimize the inventory holding and ordering costs, and balance the supply and demand. In the production process of any manufacturer, accountants and managers want to be trace costs back to the thing that creates them in order to streamline operations and increase efficiencies. These traceable costs or direct costs are expenses that can be traced back to a single cost object. Accountants can look at the expenses or outlays of cash and figure out where it was spent and why. Cost object definition and measurement are essential for cost accounting and management.

A cost object is anything for which costs are measured and assigned, like products, services, or departments. Tracking these costs ensures businesses don’t overspend on low-return relationships or overlook high-potential opportunities. With careful analysis, companies can optimize resource allocation for better financial health across all business connections. By diving into this article, you’ll discover just how critical cost objects are for accurate budgeting and nailing down cost management strategies. We’ll guide you through what they are, how they’re categorized, and why assigning costs accurately makes all the difference to your bottom line.

Let’s look at an example to better clarify the differences between the different manufacturing costs. There are two final types of manufacturing costs that may be used in discussion. In the realm of subscription-based services, the phenomenon of churn represents a critical metric… This lets managers make better decisions about how to spend their resources efficiently.